The Post-Pandemic Global Economy

By Dr. Michael Spence

Chairman of the GA Global Growth Institute

As the global economy emerged from the pandemic, strong inflationary pressures appeared for the first time in four decades – pressures directly traceable to a large imbalance between global aggregate demand and supply.

Central banks, policymakers and markets initially viewed these pressures as transitory, based on a belief that pandemic-induced supply-side imbalances and blockages would diminish and the post-pandemic surge in demand would eventually subside.1 In other words, the elasticity of the supply side response to excess demand, while delayed, would be large and relatively quick.

Indeed, there were reasons to think that some supply side constraints would subside – and some of them have faded.

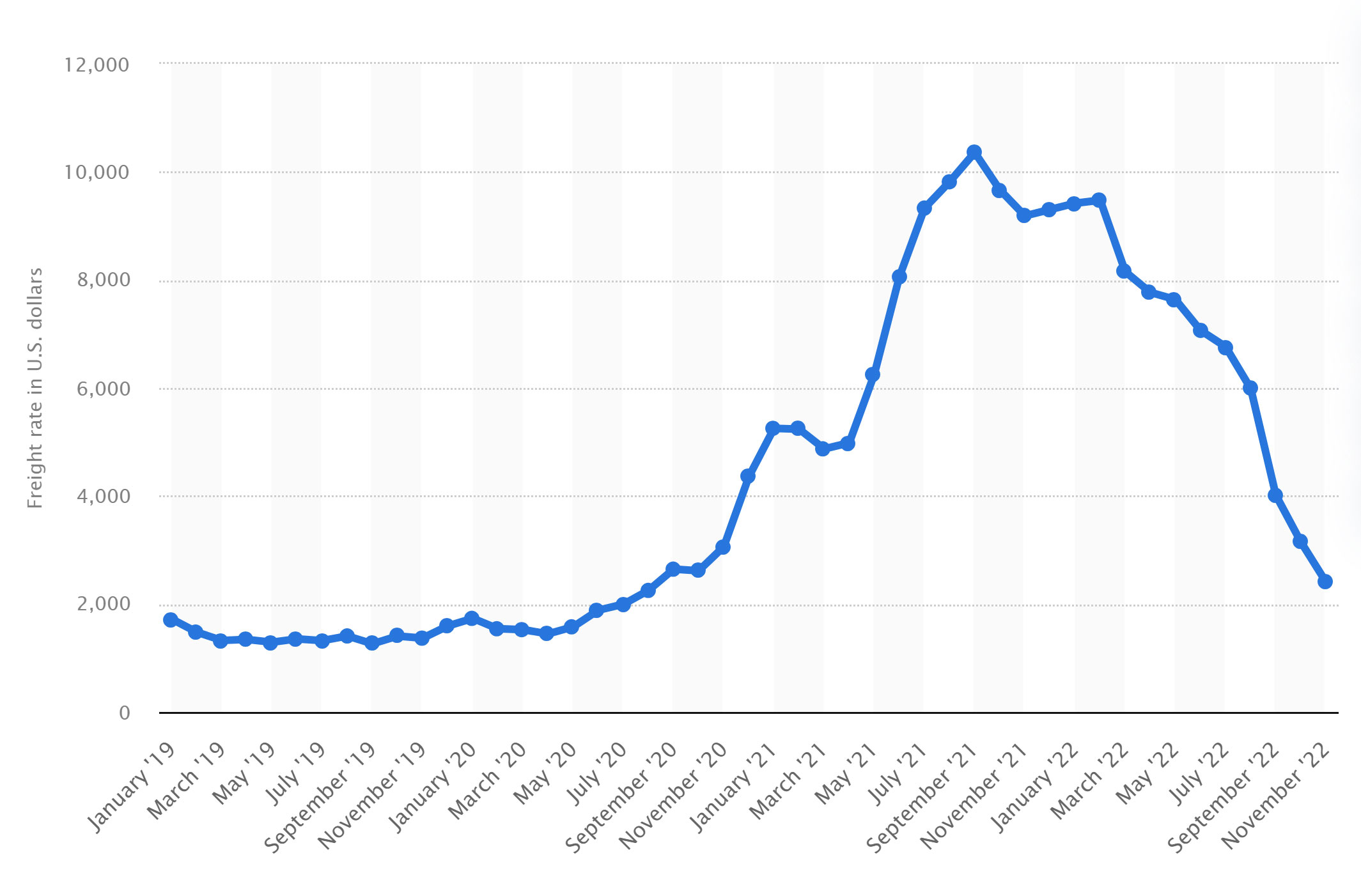

Global container freight rate index from January 2019 to November 2022 (in USD)

Ocean shipping costs, which peaked at about $10,000 per container, are back to below $3,000. Ports and land transport are clearing backlogs. Semiconductor shortages are easing, aided by a recent rapid drop-off in the pandemic demand surge for electronic products and digital services. China’s zero-Covid policy was never going to last indefinitely, and indeed, belatedly and relatively suddenly, it has been abandoned in the last two months.

If this were the whole story, then after central banks’ battles with inflation, one might expect a return to a global economy largely similar to the pre-pandemic one.

This is not going to happen. The reason is a host of secular trends, the combined effects of which amount to substantial change in the supply side of the global economy in terms of cost and response elasticities.

Seven Secular Trends Shifting Supply

1. Productive capacity

For the past forty years, one of the most powerful deflationary forces came from the arrival of previously unused productive capacity from emerging economies, with China providing the largest increment. Now, with tens of millions of middle-class consumers, the reservoir of remaining unused productive capacity is shrinking, and the deflationary forces are fading. This is the global version of the Lewis turning point – a shift in growth patterns across developing countries as they exhaust the surplus labor in traditional sectors.2

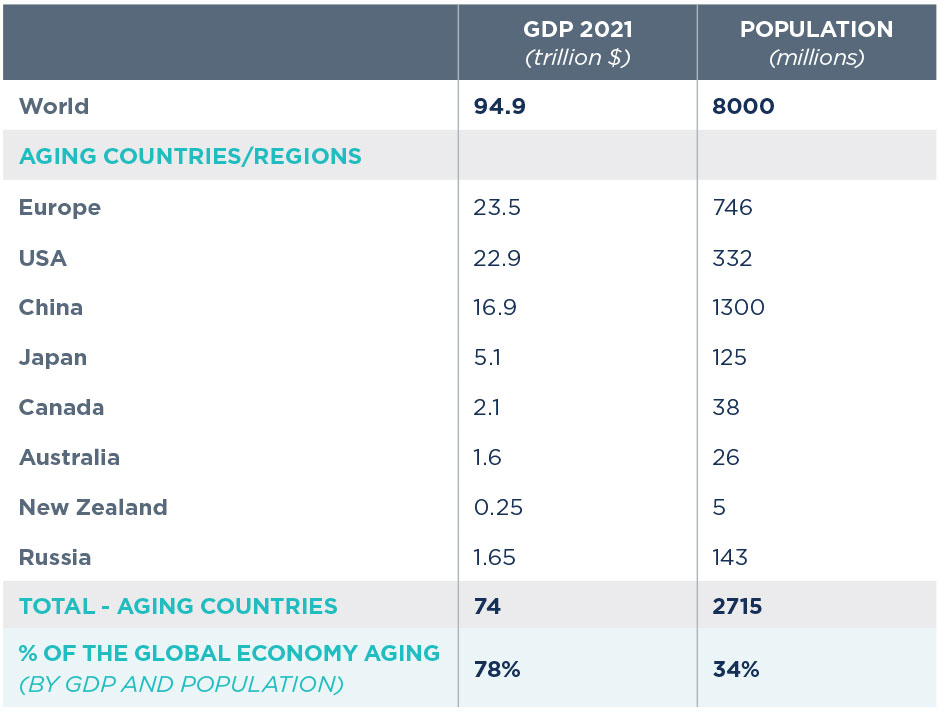

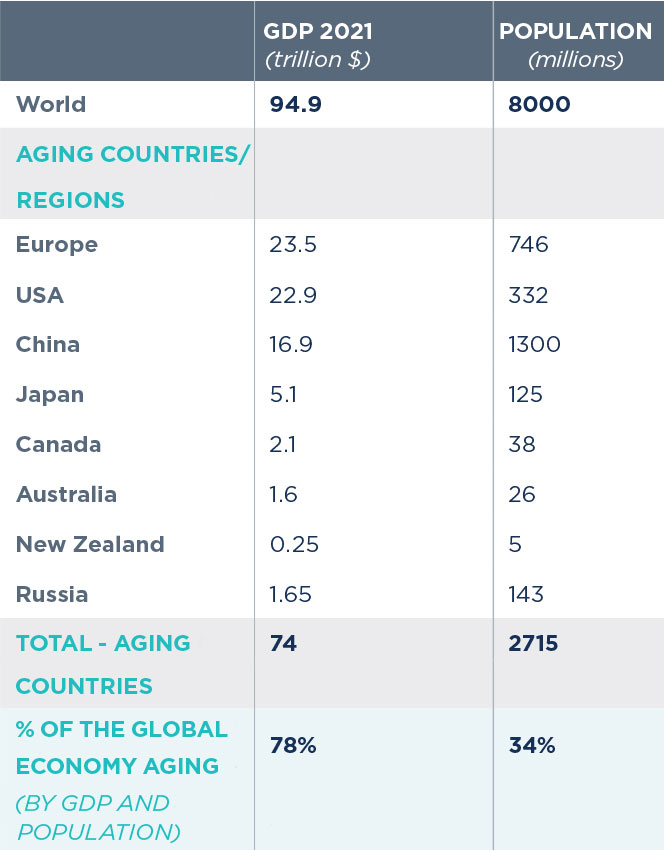

2. An aging economy

A significant part of the global economy is aging rapidly.3 My estimates are that the aging portion represents 33% of the world’s population but over 75% of global GDP.

Aging restricts the workforce and productive capacity; does not reduce demand; puts pressure on fiscal resources depending on social security system design; and increases dependency ratios, while also shifting resources to the healthcare sector.

3. Indebted economies

Sovereign debt levels are at all-time highs, most recently driven by pandemic policies designed to buffer economic shock. Globally, the post-pandemic level of sovereign debt is around 100% of GDP.4 Whether this is a serious constraint on fiscal investment (of the type required to deal with shocks and engineer the energy transition for sustainability) will be determined by whether real interest rates revert to low levels or equilibrate at higher levels.

4. Non-tradable productivity

Productivity is on a declining trend globally, but it is important to dig a little deeper to identify the key driver. The productivity problem is in the non-tradable side of the economy. For perspective, the non-tradable sector represents two-thirds of the economy and around 80% of employment.5 Changing gear in global productivity must start with services; trading of goods simply isn’t a big enough engine to power substantive change. Digital technology has the potential to catalyze such a trend reversal.

5. Structural labor market shifts

Beyond aging and retirement, people are dropping out of the labor market as we knew it or refusing to work in sectors deemed to be unsafe, highly stressful, underpaid and inflexible. These sectors experiencing labor shortages include the huge employment sectors in the non-tradable side, government, education, healthcare, retail and hospitality/travel.6 It is striking that sectors with these characteristics are experiencing labor, worker and staffing shortages. These do not look like temporary changes in supply conditions.

6. The poly-crisis of interconnectivity

The global economy is subject to more severe shocks. Shocks are not new, but the sources, frequency, severity and impacts are rising. Businesses and governments have started to diversify supply chains in response to the pandemic, war in Ukraine, geopolitical tensions and climate shocks as the poly-crisis has expanded.

7. Decoupling globalization

After the Cold War, global supply chains were constructed almost entirely on the basis of efficiency, cost and comparative advantage criteria. That era is over, and with it the arrival of aggregate supply conditions that are more resilient but more expensive, and probably less elastic. Geopolitical tensions involving the US and China will lead to some degree of diversification away from full dependence on Chinese manufacturing. Most of this is not transitory, with the possible exception of a potential end to the Ukraine war.

Taken together, these secular trends represent significant changes and substantial headwinds to growth.

But that is not all there is to the story. We are in a multi-decade shift in the global economic locus towards emerging economies – especially to Asia, home to 4.7 billion of the world’s 8 billion population, and where growth has been high in absolute and relative terms. This will redraw the architecture of global networks, the location of final demand and the balance of economic power.

In conjunction, three consequential scientific, technological and economic transformations with the potential to alter the economic landscape are also underway:

- a digital transformation of the global economy;

- a revolution in biomedical and life sciences; and

- the energy transition required to achieve sustainability and mitigate climate risks and impacts.

In all three areas, there is an explosion of technological development, entrepreneurial activity, and investment on a global basis. The days of being able to count the locations of entrepreneurial and technological hotspots on one’s fingers are firmly in the past.

These accelerating shifts have the potential to drive systemic transformation.

Rapid advances in science and technology will be enabled by powerful tools. Over time, as the costs of these tools fall, accessibility rises. Examples include solar and wind costs; cloud computing; advanced (3 nanometer) semiconductors; quantum computing; gene editing; robotics; image and speech recognitions; AI predictions of the three-dimensional structure of proteins; and many other applications of AI and machine learning across the global economy.

Applications of these and other technologies have the potential to produce a surge in productivity – in fact, they already have in the sectors that have demonstrated sustained productivity growth as noted above. They also create options for inclusive growth patterns by expanding the range of services available to remote or low access populations that do not live in urban environments with a locally dense set of service offerings. This is happening in ecommerce, finance, health and education.

Of course, hurdles to broader economic system transformation, built on new, inclusive growth patterns, remain. Funding for scientific and technological development must incentivize progress in critical areas, while businesses need to develop their understanding and use of new technologies.

Global macroeconomic policy cannot rely on the globalization playbook of the recent past; it requires a new framework and mindset. Systemic transformation – resolving the productivity and inequality dilemmas that underpin our current context – rests contingent on largely costless flows of knowledge and technology across boundaries.

Dr. Michael Spence is a Senior Advisor at General Atlantic and Chairman of the firm’s Global Growth Institute. His areas of focus include economic growth and policy in emerging markets, the influence of leadership on economic growth, and digitally enabled growth patterns.

Michael is a Nobel Laureate and serves as a co-chair with Joseph Stiglitz on the Commission on Global Economic Transformation; is a Distinguished Visiting Fellow at the Council on Foreign Relations; a Co-Chair of the Advisory Board of the Asia Global Institute in Hong Kong; and is a Senior Fellow at the Hoover Institution at Stanford University. He is the author of The Next Convergence: The Future of Economic Growth in a Multispeed World.

From 2006 to 2010, Michael was the Chairman of The Commission on Growth and Development, an independent international body that analyzed opportunities for global economic growth, with a special focus on emerging economies.

Michael is a Rhodes Scholar, and was awarded the Nobel Memorial Prize in Economic Sciences in 2001 for his contributions to the analysis of markets with informational gaps and asymmetries, and the dynamics of information flow Previously, Michael taught at Harvard University, where he served as Dean of the Faculty of Arts and Sciences, and Stanford University, serving as Dean of the Stanford Graduate School of Business.

This whitepaper has been written solely by Dr. A. Michael Spence. References to “we”, “us,” and “our” refer to Dr. A. Michael Spence and not to General Atlantic (“GA”). This document is not research and should not be treated as research. The views expressed reflect the current opinions and views of Dr. Spence as of the date hereof and neither Dr. Spence nor GA undertakes to advise you of any changes in the views expressed herein. Opinions or statements regarding macroeconomic or financial market trends are based on current conditions and are subject to change without notice.

[1] There were important warnings from Lawrence Summers, Olivier Blanchard, and Mohamed El-Erian about the magnitude of the stimulus packages in combination with accommodative monetary policy, and about the costs of delay in restraining aggregate demand.

[2] Reference to Sir W. Arthur Lewis

[3] Chart: Statista, GDP by Country (2021); World Bank Group Population Indicator by Country (2021)

[4] International Monetary Fund, Global Debt Monitor (December 2022)

[5] 2012 North American Industry Classification System (NAICS)

[6] Bureau of Economic Analysis (BEA) Employment and Real Value Added Data (in billions of chained 2012 USD)